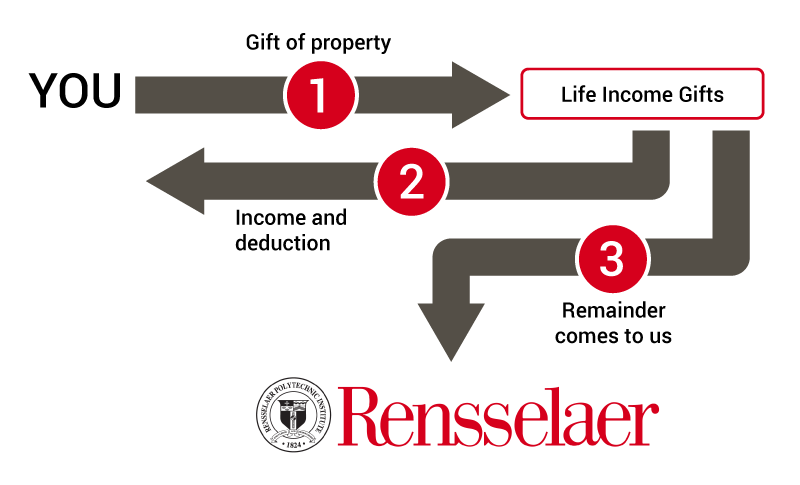

Gifts That Pay You Income

You can invest in the creative energy and entrepreneurial spirit of Rensselaer and its students while receiving income for life.

Charitable Gift Annuities

Charitable Gift Annuities (CGAs) are a great way to support Rensselaer while generating income for yourself and your family. Learn how these gifts allow you to achieve both of these goals.

You can make a substantial impact at Rensselaer while you are receiving tax-favorable income for you, your spouse, and your children. Many supporters like charitable gift annuities because of their attractive payout rates and their significant impact.

Benefits to you include:

You receive an immediate charitable income tax deduction for a portion of your gift.

Your gift passes to Rensselaer outside of the estate process.

You create your legacy of impacting the world through higher education and discovery.

Charitable Remainder Trusts

Income for life for you and your family while reducing your taxes and supporting Rensselaer.

By using appreciated assets or cash to fund your trust, you receive income and you receive a charitable income tax deduction the year in which you transfer your assets. The remaining portion of the trust, after all payments have been made, comes to Rensselaer.

Benefits to you include:

You or your heirs receive income for life.

You receive a charitable income tax deduction for the charitable portion of the trust.

You pay no capital gain tax on appreciated assets sold inside your trust.

You create your legacy of advancing our shared mission.

Complimentary Planning Resources are Just a Click Away!

Creative Ways to Make a Major Impact

I'm here to help

Drew Babitts, MBA, CAP®

Director, Gift Planning

Rensselaer Polytechnic Institute